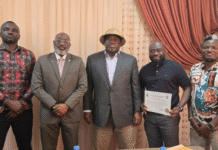

Ahead of his confirmation as Executive Governor of the Central Bank of Liberia, diaspora Liberians are commending President George Manneh Weah for the appointment of Mr. Aloysius Tarlue as governor of the Central Bank of Liberia (CBL).

According to the Liberians, mainly living in the United States of America, Mr. Tarlue appointment by president Weah was an “excellent choice” because he is someone that has the ability to transform the nation’s highest financial regulatory body.

President Weah on November 8, 2019 picked J. Aloysius Tarlue Jr as the country’s new Central Bank Executive Governor to replace former governor Nathaniel Patray who resigned last month.

Jolue Aloysius Tarlue, Jr., is a Kean University Masters in Public Administration, with 17 years of solid quality compliance experience, enforcing standards in a range of global financial institutions, mainly in the United States.

Speaking on Liberia public Radio TV on Thursday November 14, Mr. Tillman Collins, former TLA member and former president of the Grand Gedeh Association in the Americas, (GGAA) and Security Expert Moses Saygbe of Delaware USA said based on the past experiences of Mr. Tarlue, his appointment by president Weah was no mistake.

They told LPR TV that based on his qualification combined with experiences, Mr. Tarlue will make a big difference at the Central Bank of Liberia and want the Liberian Senate confirm him as Executive Governor of the bank for the betterment of Liberia.

In late 2018, President Weah appointed Tarlue as Chairman of the Liberia Electricity Regulatory Commission (LERC). Tarlue oversaw the standing up of the electricity regulator, mobilizing a pool of technicians recruited through a stringent competitive process.

With the staff, Tarlue turned to identifying power providers in the country through the conduct of an Operators Census. Just this month, he led a stakeholder validation session of the draft regulations of the LERC’, namely, The Administrative Procedure Regulations, Electricity Licensing Regulations, Licensing Handbook and Micro Utility Licensing Regulations.

Where other places has Tarlue worked?

J.P. Morgan Chase

Tarlue worked for J.P. Morgan Chase, from March 2013 up to 2018 as Compliance Officer – Quality Control. There, he provided subject matter expertise on AML/KYC and Sanction requirements to front office, lines of business and operations, and possess in-depth knowledge of BSA/AML Regulations, PATRIOT ACT and OFAC; well versed in AML and Terrorist Financing emerging trends.

He utilized research and investigative databases and software applications to conduct enhanced due diligence, and conduct firm wide risk assessments of customers, products, geographies, and distribution channels and the effectiveness of compensating controls.

He drafted and/or updated AML compliance and written supervisory policies and procedures, and assisted in developing a comprehensive cross-business view of AML risk. He reviewed and approved exceptions, and kept abreast of regulatory developments and enforcement actions to assess potential impact to JPMC.

Tarlue identified and helped resolved compliance and control issues, performed targeted reviews to validate controls and ensured they were in place and appropriate. Tarlue possesses political, social and economic knowledge of countries that are major players in the global economy and has spent years analyzing client risk due to Major Sanctioned Countries.

He advised, reviewed and analyzed risk assessments on domestic and international Corporate Investment Banking of business and product lines and assessed money laundering/terrorist financing risks and recommended mitigants and controls.

At BNY Mellon NA, the Liberian native provided sign-off approval/disapproval for the on-boarding of all new and retention of existing high-risk rated customers as Mellon`s Quality Assurance Officer. Tarlue managed customer on-boarding, account closures, detecting and escalating suspicious activity and any other AML or OFAC risks of significant complexity. He worked at Mellon for 6 years, 2008 – 2013.

Deutsche Bank NA

At Deutsche Bank NA, Tarlue was a Senior Risk Officer—client Adoption Management-Trust Securities Services for two years, 2007 – 2008 before moving on to BNY Mellon NA. He supported management in ensuring that the Lines of Business operations were in accordance with all legal and regulatory requirements and all DB standards relating to anti money laundering and sanctions, so as to protect and enhance the reputation of the Bank with its regulators and avoid significant financial loss or reputational damage.

Prior to working for Deutsche Bank NA, Tarlue worked for Merrill Lynch as the Bank`s Compliance Analyst for a year. There he assisted in assessing and mitigating the risks associated with suspicious activity identification and reporting and Office of Foreign Assets Control Compliance to ensure compliance with Federal and State laws and regulations and to minimize penalties and reputational losses.

He applied internal policies and control procedures with a knowledge and understanding of guidance, laws governing and regulations.

HSBC Bank NA

Tarlue started off with HSBC Bank NA, serving Compliance Officer role – Compliance Policy & Procedure Team. In this role, Tarlue conducted reviews on all new and existing clients, ensured that KYC profiles were in accordance with AML Regulations and HSBC policies and procedures; provided testing and feedback to senior management regarding training and system design, from a Quality Assurance perspective.

He conducted quality assurance reviews on New Business KYC profiles, across multiple business lines, ensuring AML Regulations and HSBC policies and procedures are maintained.