Liberia’s President George Weah has proposed a budget of over US$785.5 million to the legislature as he looks to fund a sweeping agenda that includes some serious investments in education, health, security, and agriculture.

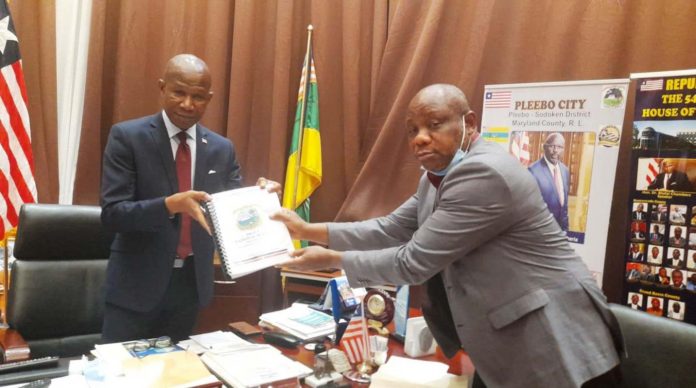

The fiscal year 2022 budget, which the Minister of Finance and Development Planning, Samuel D. Tweah, Jr, submitted on behalf of the President yesterday, carries an envelope of US$785,587,340.00.

The budget increased funding to the agriculture sector by “60.5%; Energy and Development Sector by 76.1%; security sector by 11.3%; and the Health sector by 12.3%.”

Out of this budget envelope, domestic revenue is projected at US$640,587,340 and US$145,000,000 from external resource projection.

The new projected budget has an increase of a whopping US$200,000 million, compared to the approved fiscal year budget of 2020/2021, which stands at US$570.1 million.

The growth of the budget is in part driven by the IMF Extended Credit Facility (ECF), which provides financial assistance to countries with protracted balance of payments problems.

The program also means the government commits itself to debt rules which, among other things, limit external borrowing to concessional terms and require reduced domestic borrowing from the central bank — forcing the government to increase domestic revenues by expanding the revenue base and minimizing tax losses.

However, a massive chunk of the budget goes into servicing public debts, which mature next year; fulfilling all contractual obligations; clearance of arrears; adjustments for personnel expenditures; and capital investments based on the presidential county tour as compared to funding for social benefits and integrity institutions.

The proposed budget according to experts is the highest amount in more than 40 years when the the country budget was nearing $1billion dollars.

Debts

At current, the government account deficit, according to the Ministry of Finance, is projected to widen to 22.3 percent of GDP in 2021 and further to 22.8 percent of GDP in 2022, while the country’s total debt stock as of the end of February 2020 stands at US$1.47 billion of which domestic debts account for US$604.4 million; while the external debt stock accounts for US$861.8 million.

Of the domestic debts, the Government of Liberia owes the Central Bank of Liberia US$487.5 million; commercial banks, US$65.2 million; other institutions, US$51.5 million; and claims, US$0.2 million.

For external debt, multilateral institutions account for US$748.3 million, and bilateral sources, US$113.5 million.

Most worrisome is the rising debt levels, which the MFDP argued come at a time when the country is faced with a falling growth rate has resulted in the country being classified into the category of a moderate rate of debt distress — inhibiting the government’s ability to borrow to finance projects as well as making available meaningful stimulus package for the country.

“A major challenge to the country at this crucial time is that those debts previously contracted on concessional terms are coming due now,” disclosed Samora Wolokolie in a speech at the Ministry of Information Cultural Affairs and Tourism in August. “Thus, with falling growth rate and revenue, rising expenditures, and widening current account and fiscal deficits, the country risks defaulting on its debt service obligations.”

As of February 2020, the government spent US$21.4 million to service debt, of which principal repayment amounted to US$7.6 million; interest payment, US$12.8 million; and subscription, US$1.0 million.

Of the principal repayment, domestic debt accounted for US$2.2 million, with payments made entirely to debts owed to other institutions while external debt accounted for US$5.4 million, of which multilateral sources account for US$4.1 million and bilateral sources, US$1.3 million.

For interest payment, domestic debt interest amounted to about US$8.0 million, of which US$5.9 million was paid to commercial banks and US$0.2 million was paid to other institutions.

This made interest paid on external debt amount to US$4.8 million, with interest paid on multilateral debt amounting to US$3.8 million, while bilateral debt amounted to US$1.0 million.

Macroeconomic outlook

In spite of the debt situation, Liberia’s economy is expected to recover and return to a relatively strong growth path over the medium term by 3.3 percent in 2021 and rise to an average of 4.4 percent during 2022-23 as economic activity picks up in the productive sectors, especially mining, agriculture, and construction.

The headline inflation rate is expected to moderate further to a single digit in 2022 as the annual average inflation rate is expected to decline to 9.8 percent in 2021 and further to 5.5 percent by 2023.

Moreover, the fiscal deficit is projected to narrow to 2.9 percent of GDP in FY2021, and further to 2.0 percent of GDP by FY2022 as revenues improve and the Government maintains its tight expenditure controls.

In spite of these positive numbers, Liberia’s external position is expected to deteriorate further by the end of the year as import demand rises faster than export growth.

According to the government, there may not be enough to create the fiscal space needed to support a resilient recovery as policy options for increasing fiscal space are anchored fiscal policy on debt sustainability, external assistance in debt relief, debt service suspension, debt restructuring, and concessional loans.

“The outlook assumes high levels of uncertainty around the evolution of the COVID19 crisis with risks tilted to the downside. The resurgence of the COVID-19 pandemic and its likely impact on external demand and global and domestic supply chains; delayed access to vaccines, as well as low confidence, and unaddressed vulnerabilities in the financial sector could undermine economic recovery, increase poverty, and weaken Liberia’s fiscal and external balances,” the government said via Ministry of Finance.

Meanwhile, the House of Representatives has begun scrutinizing the draft national budget. However, the House excluded the Public Account and Expenditure Committee from reviewing the draft budget.

The move by the House is rare and has not occurred in the past.

Members of the House, during their 9th day special sitting, voted to allow only the committee on Ways, Means and Development Planning to probe the budget.

The motion to forward the bill to the committee was proffered by Montserrado County District #8 Representative Acarous M. Gray, while amendments to the motion to include the excluded committee by Reps. Dixon Seeboe, Ben Fofana, and Richard Koon, were denied.

The budget submission is in-line with section 65 of the amendment and restatement of the PFM act of 2009, which provides for the change in the fiscal year, which begins in 2022. The new fiscal year will now run from January 1 to December 31.

However, the budget should have been submitted in October, according to the amended PFM Law of 2009. Therefore it is about 17 days late.

The Public Account and Expenditure Committee came into existence to help with proper scrutinization of the appropriation budget and audit reports from the General Auditing Commission (GAC). It is a function that the committee has been performing for the last 8 years.

The Ways, Means, Finance & Development Planning Committee is expected to report to Plenary in two weeks.

Comments are closed.