Members of the Liberia House of Representatives have rejected the third amendment of the Arcelor Mittal Liberia mineral development agreement (MDA) with the government, saying “it would not serve the national interest” to have the agreement become law.

According to local media in Liberia the rejection of the US$800 million agreement comes as members seek to build an ambitious legacy of being in the interest of the people after signing concessions agreements in the past including the first and second amendments of the Arcelor Mittal Liberia concession agreement.

Report also say the AML 3rd amended agreement which is expected to be one of the largest mining projects in West Africa — was rejected after the House could not agree with the Senate version of the bill despite the latter proposing a conference as a means of resolving all of their recommendations before forwarding the agreement to the president for his signature.

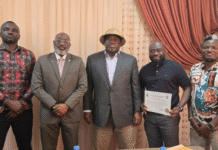

In September 2021, Liberian president George Weah and the chairman of Arcelor Mittal worldwide Laskmi Mittal put pen to paper for the signing of the US$800million deal in order to amend the company agreement to be extended for additional 15 years.

However, the new amended version of Arcelor Mittal Liberia Mineral Development Agreement seeks to provide more jobs for more than 2000 skilled and unskilled workers.

House Speaker Bhofal Chambers described the decision taken by the House plenary as the ‘greatest achievement to humanity after the bill was rejected by them on Monday during a special session.

“All that we do is that we seek the best interest of the Liberian people,” the Speaker said. “In the wisdom of Plenary, they have decided to… address the interest of our people. I think this is one of the greatest achievements of humanity — to serve our people selflessly,” Speaker Chambers noted.

New iron ore company favor?

Some political pundits told Liberia Public Radio that the latest rejection is intended to favor a new mining; High Power Exploration (HPX), an exploration company opting to carry out iron ore development in Nimba Guinea Mountains.

Last November, HPX and the Sumitomo Mitsui Financial Group (SMFG) announced on its website that pre-feasibility study for the Nimba Iron Ore Project was positive and encouraging.

HPX is a privately-owned, U.S.-domiciled mineral exploration and development company while SMFG is a Guinean incorporated mining company. SMFG is an 85% owned subsidiary of High Power Exploration (HPX).

The Nimba Iron Ore project, is the innovation of U.S.-Canadian investor Robert Friedland who acquired HPX in 2019.

The company expects eventual production of up to 30 million tons a year with construction forecast set to begin in 2023.

The project is located in the Guinean Nimba Mountains, in south-eastern Guinea, adjacent to the Liberian and Ivoirian borders.

However, the project will depend hugely on Liberia’s Port of Buchanan for export.

A pre-feasibility study done by the company estimated total project development costs at $2.77 billion and direct capital costs for rail and port development in Liberia at more than $600 million.