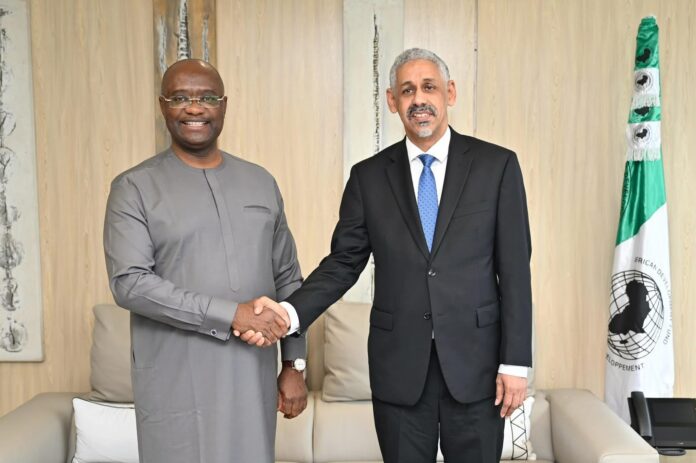

The presidents of two of Africa’s foremost financial institutions—the African Development Bank (AfDB) Group and the African Export-Import Bank (Afreximbank)—met in Abidjan on Saturday, November 29, 2025, to commit to deeper collaboration aimed at accelerating African integration, trade, and development.

Dr. Sidi Ould Tah, President of the AfDB Group, hosted Dr. George Elombi, President of Afreximbank, at the Bank Group’s headquarters. Their discussions centered on leveraging their combined financial and strategic muscle to effectively support the goals of the African Continental Free Trade Area (AfCFTA).

The meeting comes shortly after both leaders assumed their respective roles in 2025—Dr. Ould Tah in September and Dr. Elombi in October. Their shared vision for the continent is expected to catalyze new joint initiatives focused on three critical areas:

Afreximbank aims to double its support for intra-African trade to $40 billion by 2026. AfDB’s involvement is crucial for mobilizing capital and providing risk guarantees for businesses operating across African borders.

Both banks recognize logistics challenges as barriers to trade. Collaboration will likely focus on co-financing transport corridors, ports, and energy interconnectors. Afreximbank is advancing a $1 billion single transit guarantee program to eliminate border bottlenecks.

Industrialization and Value Chains: The partnership will prioritize investments that support African value addition and regional value chains, reducing reliance on raw commodity exports.

A Renewed Mandate for Development

The AfDB, as a founding partner of Afreximbank, has a long history of supporting the trade bank through significant packages. The meeting between the new presidents renews this strategic partnership at a pivotal time for the continent.

Dr. Sidi Ould Tah, a Mauritanian economist and seasoned development banker, known for institutional transformation in his previous roles.

Dr. George Elombi, a Cameroonian lawyer with nearly three decades at Afreximbank, focused on structural change in African trade, emphasizing processing and production.

Synergy for Agenda 2063

The synchronicity in their leadership and mandates is expected to create significant synergy, ensuring that Africa’s leading multilateral financial institutions are optimally coordinated to deliver transformative economic growth and realize the aspirations of the African Union’s Agenda 2063.